5 Financial Tips for Travelling With a Chronic Illness

Due to the high cost of healthcare it may seem that once you are diagnosed with a chronic illness, many previously attainable luxuries, such as travel, are now out of reach. But while chronic conditions can make one feel isolated in addition to feeling financially worse-off, the reality is that almost 1 in 2 Singaporeans are at risk of developing one. The good news is that living with a chronic condition doesn't have to stop you from exploring the world. Below, we discuss several financial tips and habits that can help you save some extra cash and remain well-protected when travelling abroad.

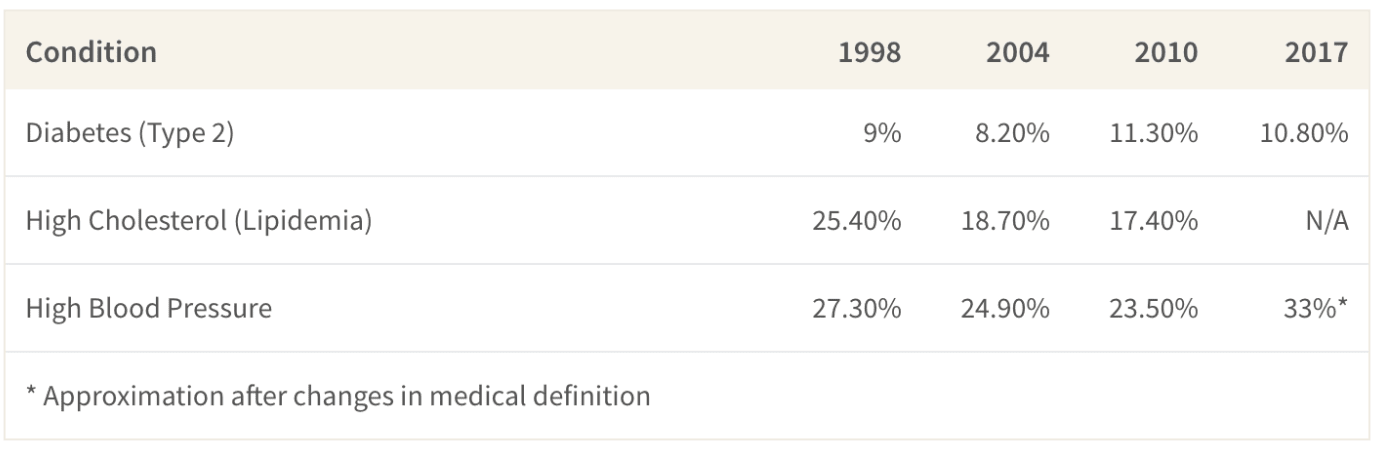

Most Common Chronic Diseases in Singapore

According to the World Health Organisation, a chronic disease is a disease with a slow progression and has a long duration that requires long-term treatment. Some of the most common chronic illnesses that affect Singaporeans are diabetes, high blood pressure (hyperlipidemia), high cholesterol, asthma, certain cancers and heart disease. Diabetes is one of the most common chronic conditions in Singapore, affecting roughly 11% of Singaporeans between the ages of 20-79. It also tends to cause some of the other chronic conditions such as high cholesterol and high blood pressure. Younger Singaporeans also face chronic respiratory illnesses such as asthma. While some of these illnesses are caused through lifestyle habits, some are hereditary and may unfortunately be unavoidable.

The cost of chronic illnesses treatment is high, with diabetes costing individuals on average S$2,035 per year, heart disease costing S$8,372 on average and cancer costing potentially over a hundred thousand dollars. With the average Singaporean family spending around S$2,300 for a vacation, chronic illness treatments could significantly decrease a family's ability to take a vacation. Still, there are some ways for them to manage down their costs to be able to travel even with chronic illness in their family.

Incidence of 3 Common Chronic Illnesses in Singapore (% of Population)

Look Over Your Insurance Options Carefully

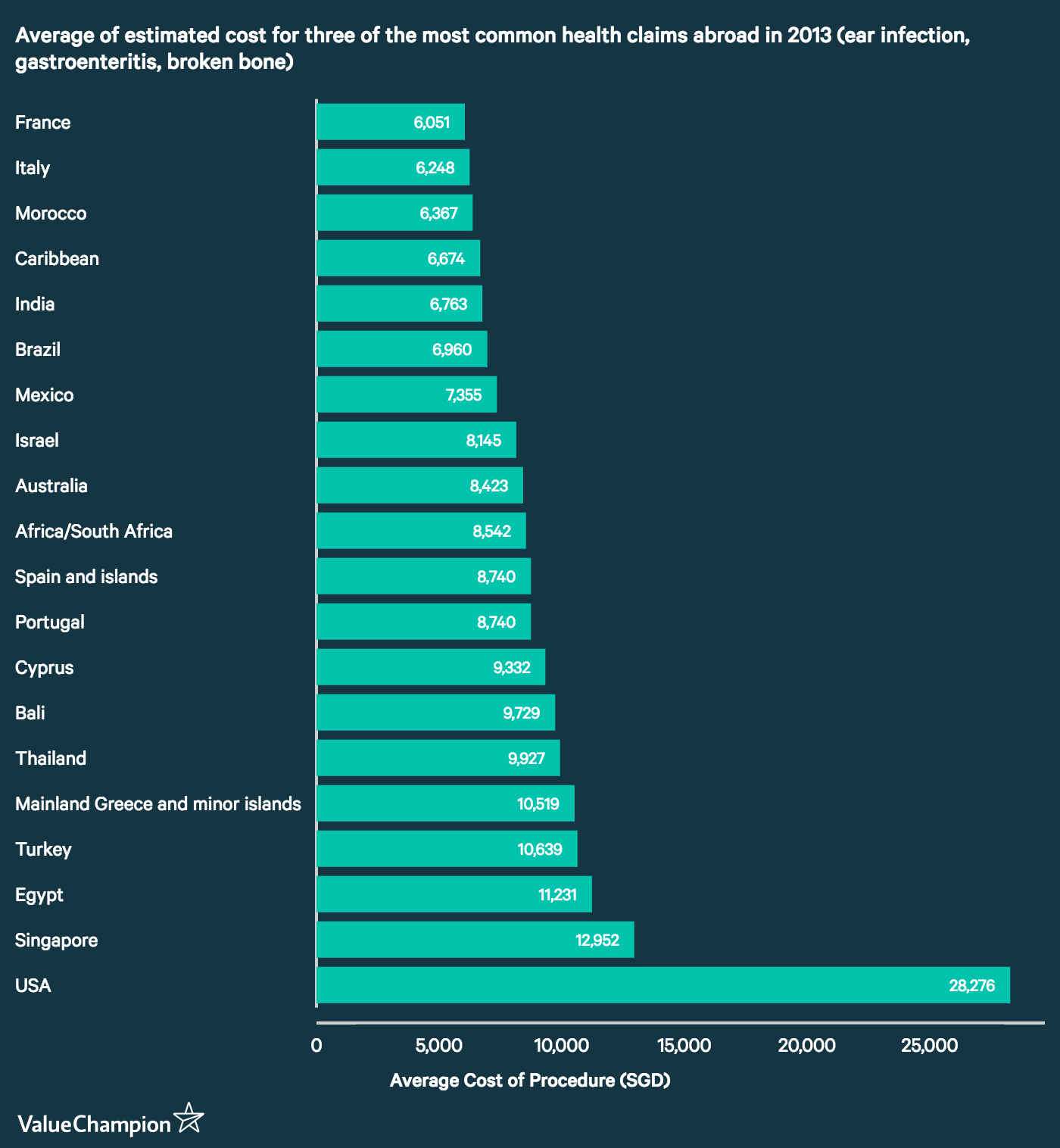

The most expensive thing that can happen to you when travelling is a medical emergency that lands you in a hospital. With some countries having outrageously high hospitalisation costs, travelling with conditions that may require an emergency doctor's visit can be very stressful. Furthermore, most travel insurance policies will refuse to cover you for your chronic illnesses as they will be considered pre-existing conditions.

However, there are some travel insurance policies that are lenient on pre-existing conditions, offsetting some of the cost should an accident surrounding your condition arise. For example, insurers like NTUC Income offer special travel insurance plans that are designed to cover pre-existing conditions such as diabetes, hypertension and asthma. However, because these plans are rare, you should be prepared to pay a higher premium than you normally would.

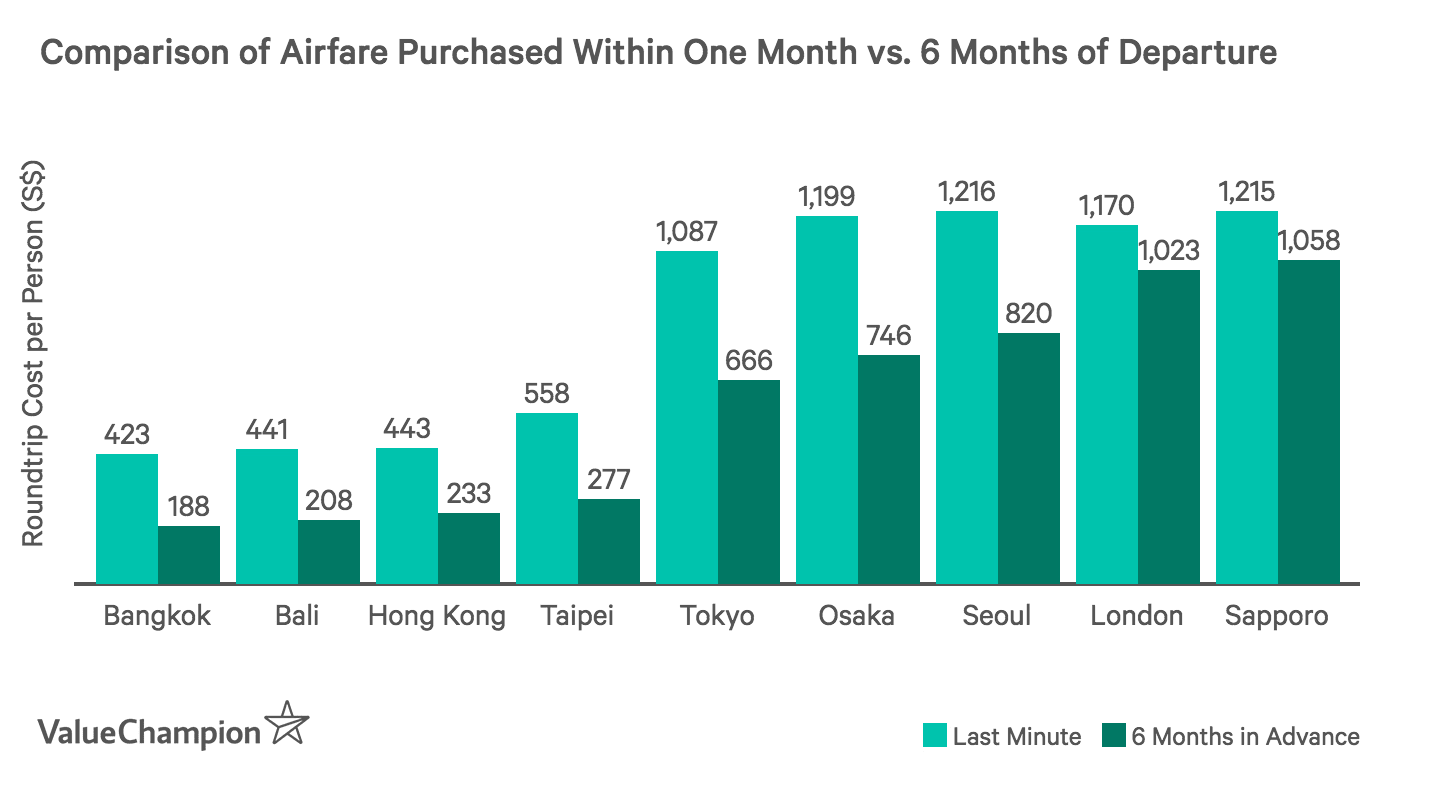

Take a Longer Time to Plan Your Trips

With all the new medical costs you'll be facing, booking last minute trips will be much more difficult to do. Since you would have to get your doctor's clearance and make sure you have enough medication for your trip, you may feel disheartened that you can't just up and fly to a new destination a moment's notice. However, booking trips in advance is actually much more financially savvy. Not only will booking your trip in advance give you ample time to get your medical needs in order, but booking in advance can save you hundreds of dollars. For instance, you can save between 25-80% on airfare by booking a trip 3 to 6 months in advance as opposed to trying to get a last minute flight.

Furthermore, booking a trip in advance means that you will have enough time to get all your medications and doctor's notes in order. Not only will this help save on out of pocket costs, but making sure you have enough medication for your trip is vital because medication can be costly or hard to get overseas without a prescription. To save on costly prescription medications, you can utilise the MediSave500, which covers up to S$500 of outpatient treatments for chronic conditions and lets you use it for consumables such as insulin pens and aerochambers. This, on top of MediShield Life and supplemental insurance, can help alleviate some of the costly outpatient expenses.

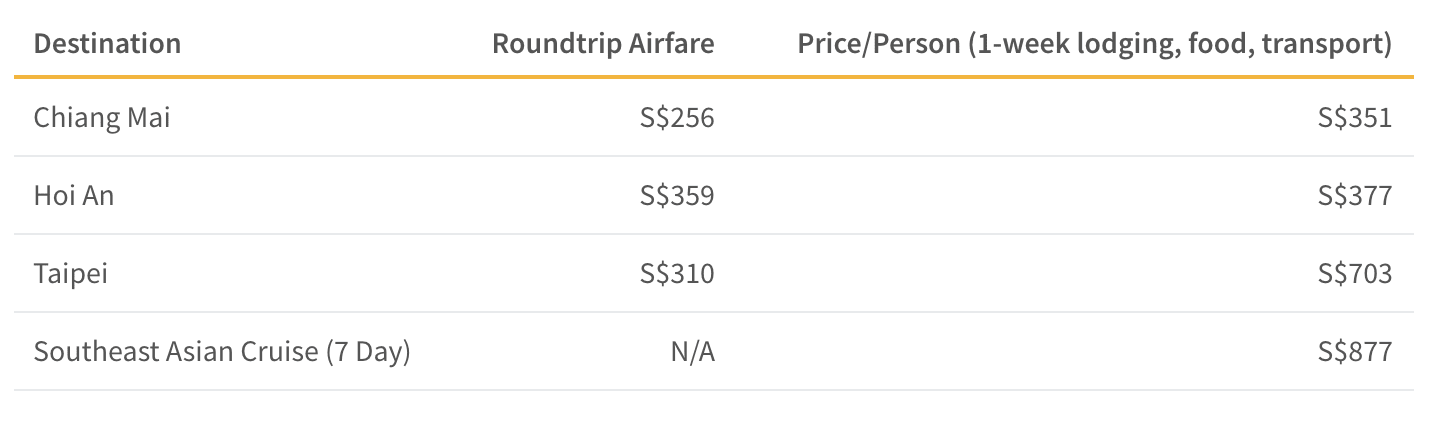

Save By Reducing Your Itinerary or Staying Local

While you may be dreaming of going to Iceland or the United States, it may be more difficult when you are suffering from a severe chronic illness. Additionally, flying to far flung places can also set you back between S$3,000 and S$7,500 per person for a week. Instead, we recommend getting creative with local destinations. Not only are they cheaper (a one-week vacation to Bangkok can cost as little as S$455), but there are often new and overlooked locations that can offer a plethora of interesting and healthy activities. For instance, Chiang Mai and Hoi An have easily accessible tourist attractions and provide healthy tourist activities including day hiking and biking trips for under S$100. Seeing as how some chronic illnesses can be mitigated with a change to a healthier lifestyle, these affordable vacations can also double as wellness getaways.

Take Advantage of Government Aid

Even if your condition doesn't require inpatient hospitalization treatment, you may still find yourself struggling to save for travel due to ongoing outpatient treatment and medication. However, Singapore offers several schemes and subsidies beyond Medisave and MediShield Life that can help you reduce some of these miscellaneous costs. For instance, if you qualify under the Community Health Assist Scheme (CHAS), you can get a S$480 subsidy for your chronic condition. Additionally, if you are over 60, Flexi-Medisave allows you to use an additional S$200 for outpatient treatment. If you are able to utilise these schemes in full along with a comprehensive health insurance plan, you may be able to offset most of the costs associated with your condition and save that much more for your holidays.

If You Are At Risk, Consider Prevention Over Treatment

The best medical advice usually discusses prevention over treatment. This line of thought applies to managing your personal finances as well, especially if you are trying to budget for a vacation. If you know your family already has a history of one or more of these chronic conditions, it is worth building a habit of getting screened and adopting a healthier lifestyle. After all, spending around S$100 per month for a gym membership is cheaper than spending thousands of dollars per year on treating your condition and paying much higher health insurance premiums. Even if your chronic illness is hereditary, making sure you are exercising regularly, eating healthy and reducing stress can delay the illness's onset and give you more financial freedom to save for a great vacation.