Singapore's Mortgage LTV Ratio is Rising: Is There Cause for Concern?

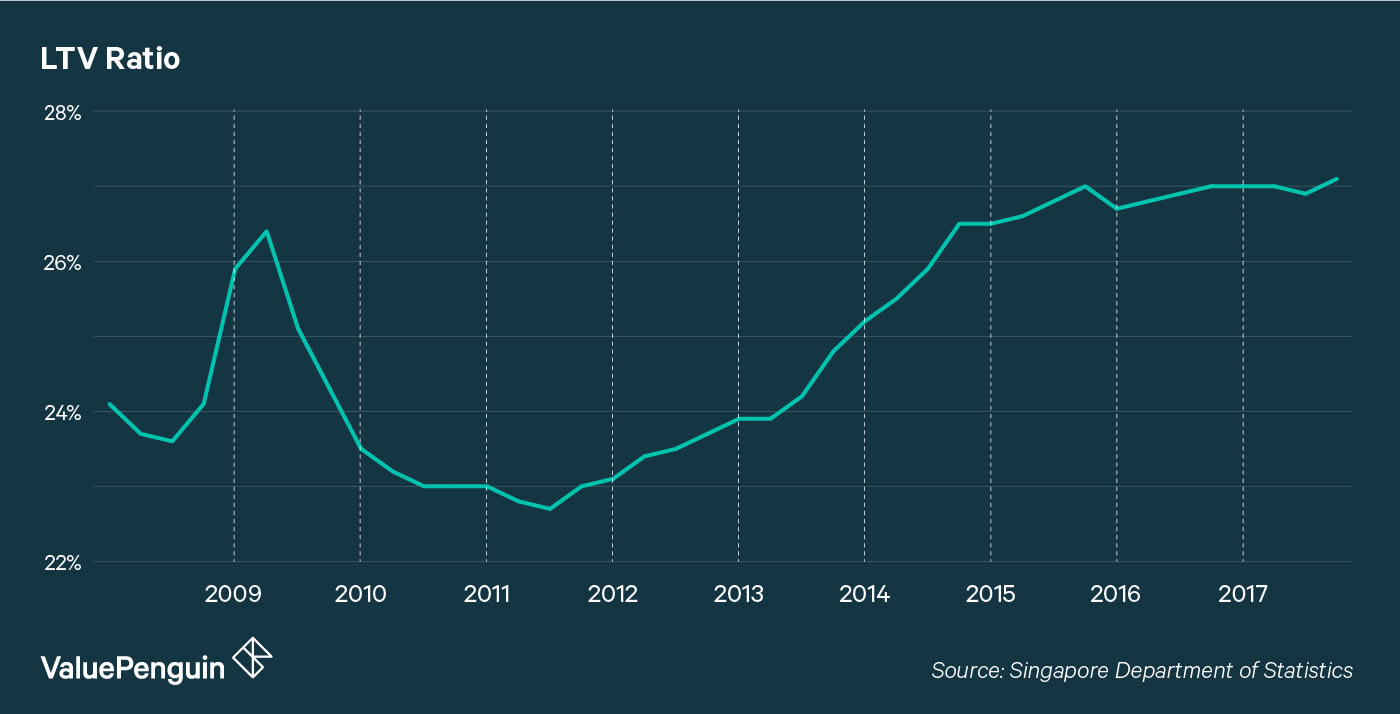

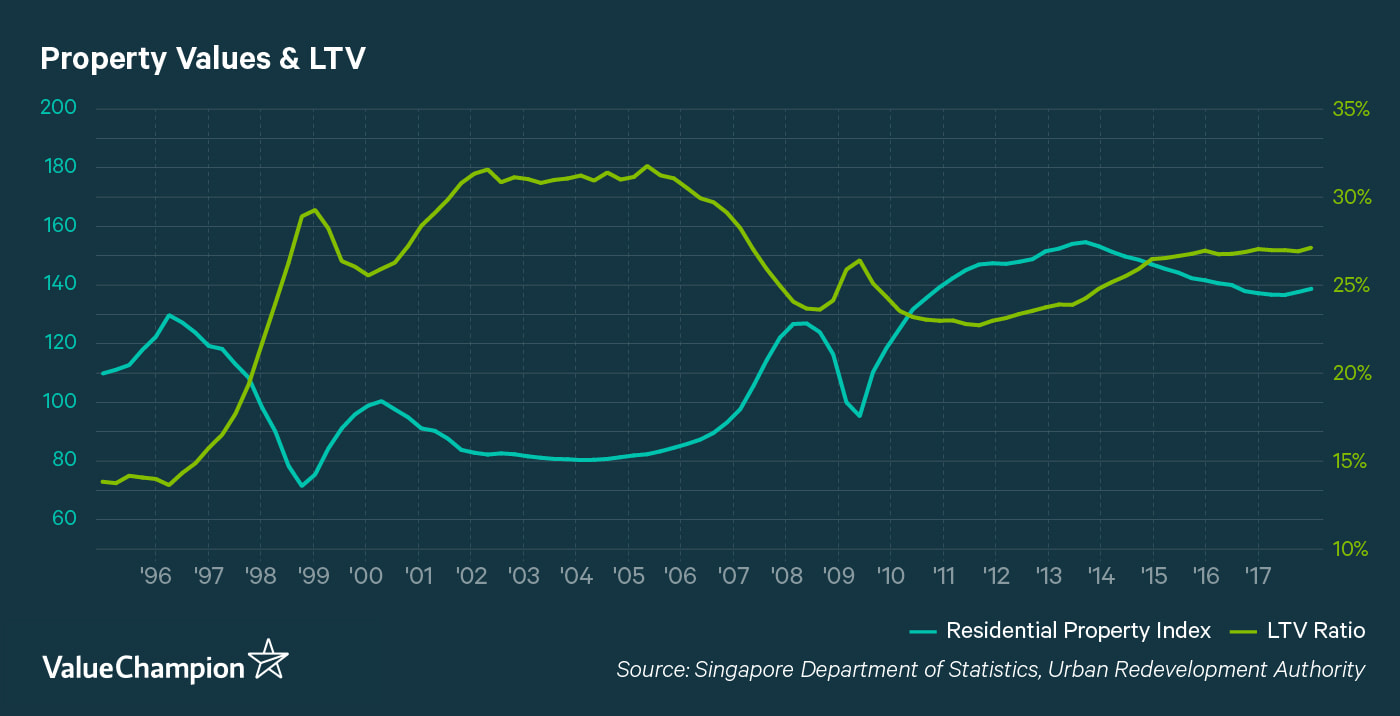

The loan-to-value ratio (LTV) (as measured as mortgage loan balances divided by residential property values), which is a statistic that illustrates the degree of leverage in the housing market, has increased in recent years to levels seen before the 1998 and 2008 recessions. In this article, we discuss causes of a rising LTV and implications for consumers.

Why Does It Matter?

As a function of mortgage balances and home prices, LTV fluctuates based on consumers' willingness to borrow and hence their risk tolerance. In years that consumers and lenders are more willing to accept risk, they tend to use higher levels of debt to finance home purchases. This causes LTV to rise as loan sizes become larger relative to home prices.

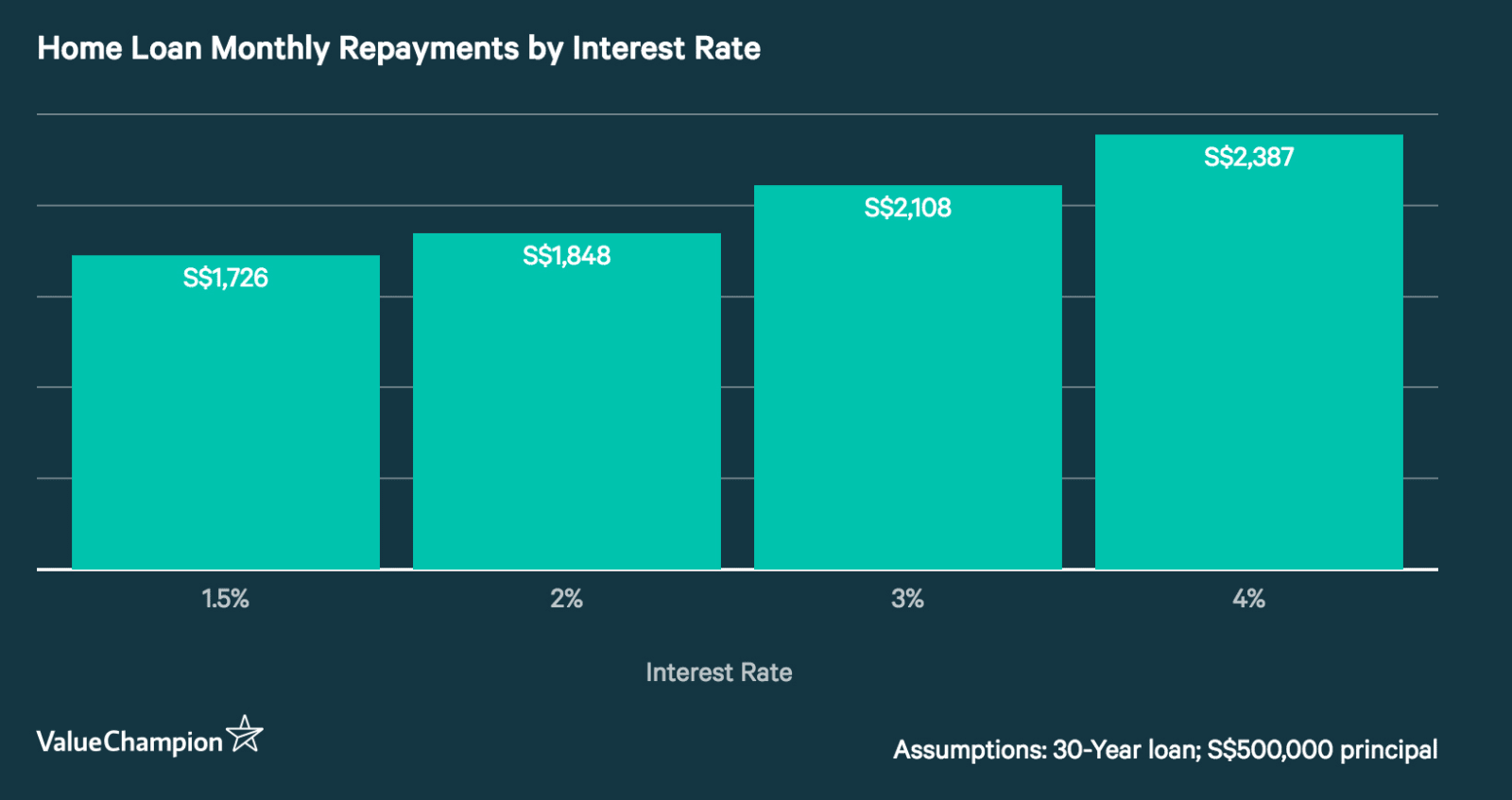

A high LTV ratio becomes problematic if homeowners are no longer capable of repaying their loan. For instance, when interest rates rise, monthly payments become more costly. For example, you would expect to pay monthly payments of S$1,848 on a 30-year home loan of S$500,000 with 2% interest rate. However, this could increase by 30% to S$2,387 if interest rates rise to 4%. For those on a tight budget, that could be a relatively big change in their lifestyle.

Not only that, property values tend to fall causing LTV to increase further during recessionary years. This generally spells trouble for homeowners, as they rapidly lose equity in their home as their home value decreases and their mortgage balance does not. In some cases, this can lead to an increase in loan defaults.

Why Is LTV Rising?

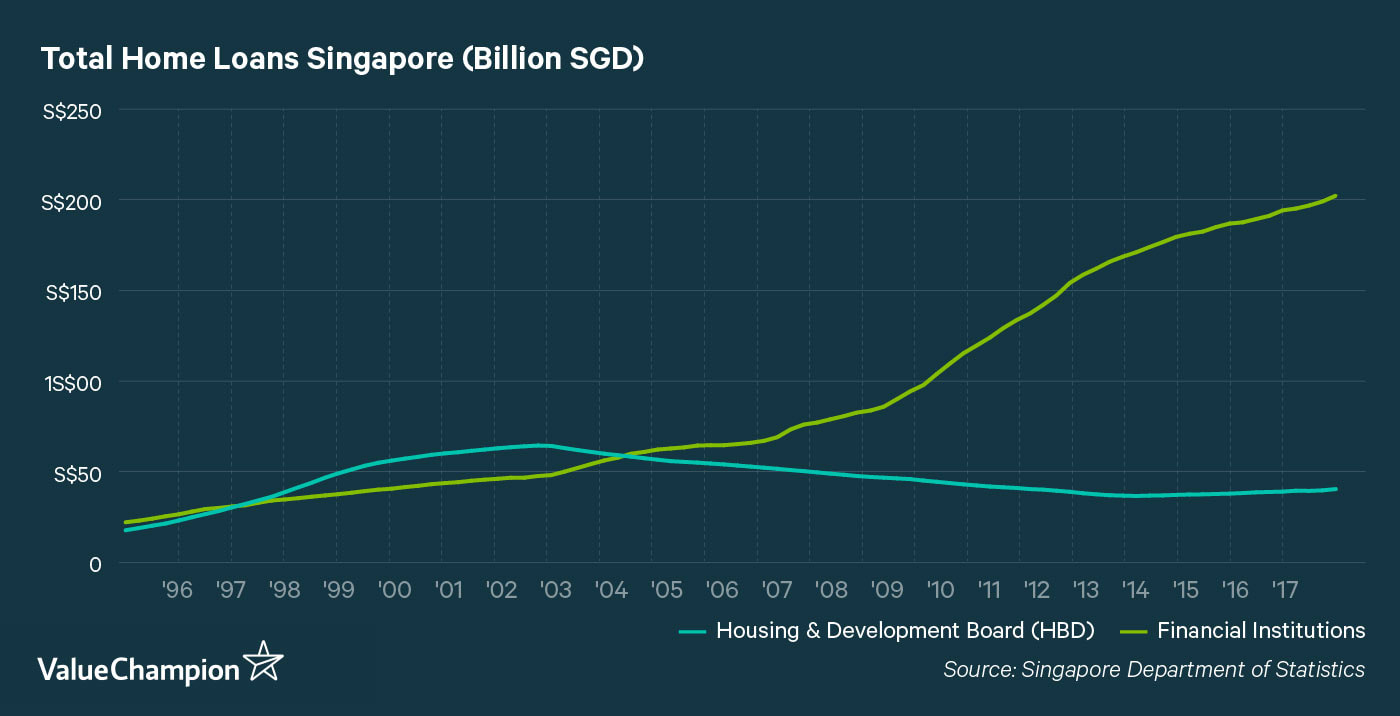

Since 2004, private financial institutions have become the primary source of home loans in Singapore. By the end of 2017, Singaporean homeowners owed S$200 billion to financial institutions and S$40 million to the Housing & Development Board (HDB). This is a drastic change compared to the beginning of 2004 when loans from HDB (S$60 billion) exceeded mortgages from private lenders (S$56 billion). It is possible that private lenders are increasingly allowing home buyers to make only the minimum downpayment (20% of home value), thereby decreasing the LTV ratio of many individual loans and the overall LTV.

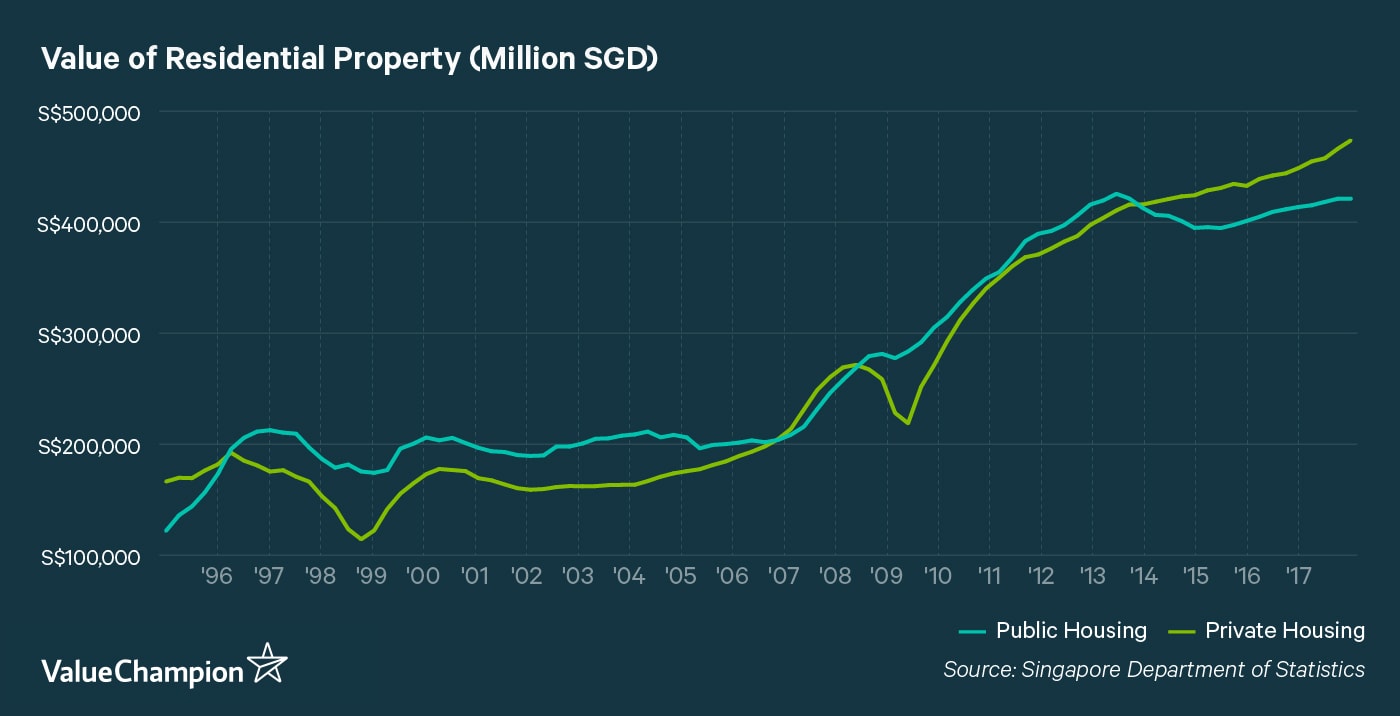

The recent climb in LTV appears to be accompanied by two other trends. First, there has been a slight decline in HDB property prices over the past few years, during late 2013 to 2014 period in particular. While HDB prices seem to be stabilizing, this is a trend worth monitoring especially given the recent discussions around 99-year lease of public housing. Simultaneously, an increase in private home values may be increasing consumers' confidence and encouraging riskier and more speculative lending and borrowing activities, resulting in a higher LTV ratio.

Cause for Caution & Planning, Not Panic

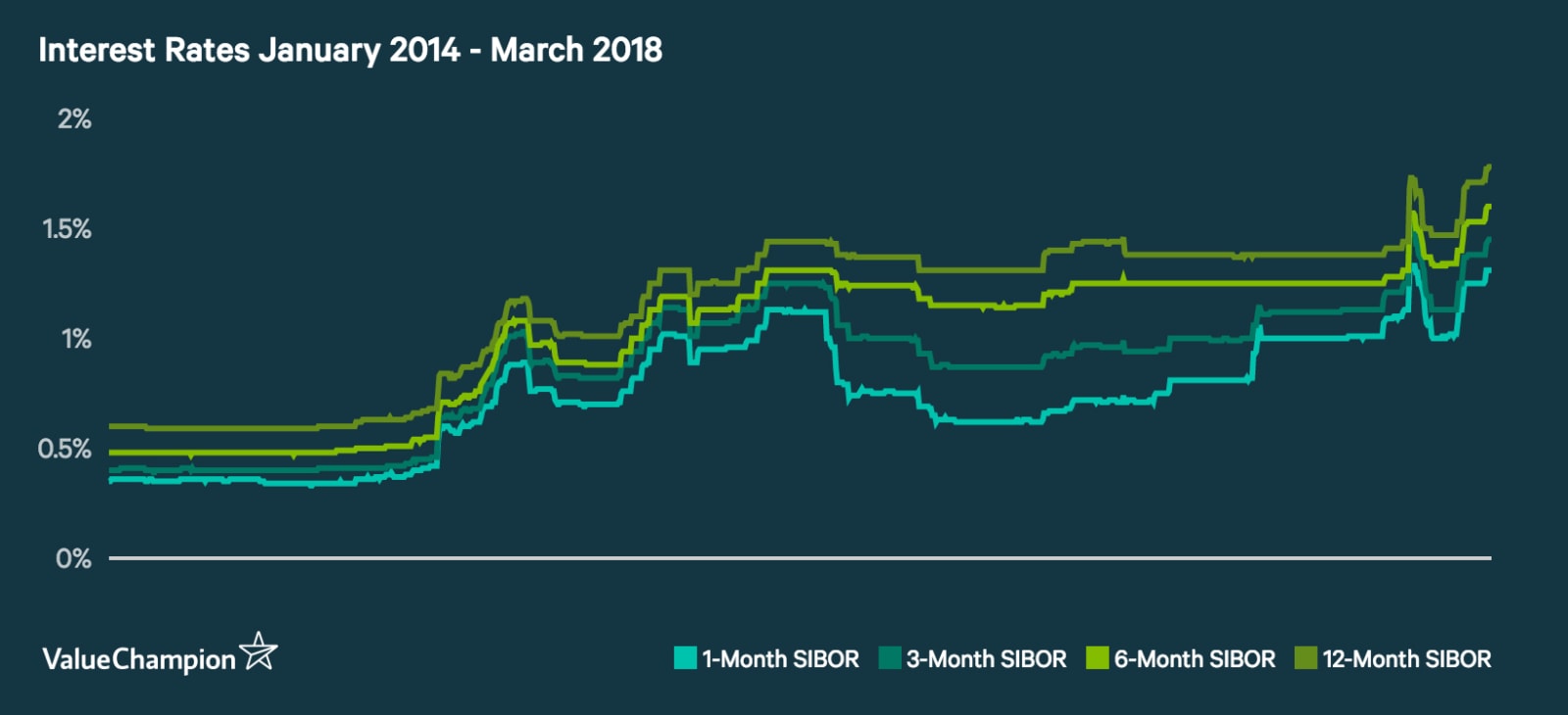

If the market LTV ratio is very high, it suggests that many homeowners may have levered themselves up excessively with mortgages. It also indicates that the housing market faces a greater risk of crashing. This is because non-repayment becomes more likely as interest rates rise and the cost of home loans soar. The 3-Month SIBOR rate has already increased from 0.94% in March 2017 to 1.45%, and is expected to increase further in the next few years as the U.S. Federal Reserve continues its rate hike. This is another indicator for potential home buyers to consider, because homeowners that are highly levered are at risk of having their loan become significantly more expensive over the next 3 to 5 years than when they initially purchased their homes.

Additionally, the issues surrounding HDB lease expirations increase uncertainty in the housing markets. As 99-year leases begin to approach their expiration, there are concerns that current leaseholders may not receive adequate resale value as prospective home buyers are wary of purchasing a lease that they may outlive. This issue is far from resolved, but is another topic to monitor in the Singaporean housing market.

The gradual increase in LTV should not yet cause fear of an impending recession. LTV was significantly higher in 2002 to 2005, years before the global financial crisis in 2008. It is a good reminder; however, for homeowners to be conservative with how much housing loan they are getting to purchase homes, and to avoid purchasing a more expensive property than they can afford. Although borrowers are required to make a down payment of at least 20% in order to purchase their new home, that means a 5 - 10% decline in housing prices can wipe out 25 - 50% of their equity. Additionally, these consumers should keep an eye on interest rates, which may continue to rise after a period of very low levels. A loan may seem affordable now, but it may not be after 2 to 3 years when rates have increased from around 2% to 3-4%.