3 Ways to Do Well By Doing Good

At first glance, it may seem that maintaining your own personal financial stability is at odds with helping others. However, there are several ways to do both if you are interested in making a difference, while saving or earning money. Here, we outline 4 financially strategic ways to make the world a better place while also benefiting yourself.

P2P/Crowdfunding Investing

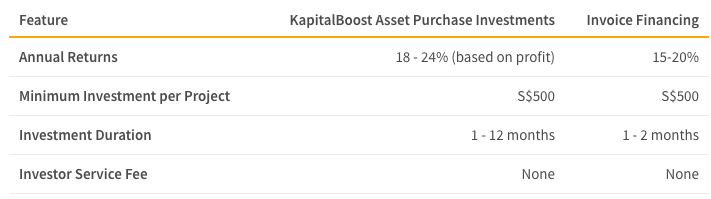

Crowdfunding lending platforms allow small businesses to raise money from large groups of individual investors. At the same time, investors on these platforms in Singapore can earn competitive returns by loaning to small businesses, helping them survive and thrive. One example, the Islamic P2P/Crowdfunding site KapitalBoost, features a strict ethical screening process to ensure that its investors are making societally conscious investments. Additionally, offers annual returns as high as 24%, making it an exciting way to ethically invest in local SMEs.

Socially Responsible Investment (SRI) Funds and Impact Investing

Socially responsible investment (SRI) funds are rapidly growing in popularity. These funds screen out businesses that have a negative environmental or social impacts or produce or sell addictive substances. Individual investors can make societally beneficial investments through SRI funds using a brokerage account. These funds have even been found to outperform traditional investments. For example, sustainable equity mutual funds outperformed traditional mutual funds for 64% of the periods studied between 2007 and 2015. Additionally, the study found that the MSCI KLD 400 Social Index outperformed the S&P 500 by 45 basis points during the previous 15 years.

Impact investing is a similar to SRI, in that both are private mission-driven investing methods. However, there are a few differences. First, impact investments are made in charities, schools and foundations in addition to businesses. Additionally, impact investors typically track the real-world impact of the the private investment in addition to the financial returns from the investment. Subsequently, SRI funds tend to offer higher annual returns (as high as 25 - 35%) than impact investing, as they are primarily focused on financial returns and use social and environmental factors strictly as a screening process. However, impact investing is also known to generate decent annual returns (typically 4 - 9%) and tend to have more socially tangible impact than SRI.

Donate to Your Favorite Charity

Did you know that donating to charity can actually save you money by trimming your tax bill? Cash donations to charities approved by the Institution of a Public Character (IPC) or the Singapore government are tax deductible. This deduction allows you to support a good cause and be rewarded with a smaller tax bill.