With Interest Rates at a 10-Year High, Is It Still Worth Refinancing Your Home Loan?

In Singapore, it is common for homeowners to refinance their home loans every few years in order to secure the lowest available interest rates. However, in the past few months SIBOR rates have reached their 10-year high, which might worry those homeowners that may be considering refinancing their loans. In this article, we present key factors for these individuals to explore when considering whether they should refinance in current interest rate environment.

Why Refinance in the First Place?

Individuals that have passed the lock-in period of their home loan may want to refinance their mortgage in order to obtain a lower rate and thus reduce their total cost of borrowing. Because banks tend to offer competitive home loan refinancing rates in order to attract new customers, individuals may be able to save money by refinancing. Even switching to a slightly lower interest rate can result in significant savings. For example, a lot of mortgages loan in Singapore offer lower rates in the first 3 years, and then charge higher rates thereafter. If the initial rates were 2.5% and the later rates rise to 3%, a borrower would make monthly payments of S$2,243 during the first three years and then S$2,357 going forward. However, refinancing the home loan after the third year through another bank at a lower rate of 2.25% will be able to lower this monthly payments to S$2,187 and reduce the total interest cost by 25% compared to if he/she had stayed with the original loan. This highlights the real difference a seemingly small difference in interest rates can have on a homeowner's finances.

If you are a homeowner with a home loan that is eligible for refinancing, you may want to consider checking the best refinancing offers available. By checking these rates periodically, you'll get a sense of how much you could save given the current lending market environment. If market rates are lower than what you are currently paying, it likely makes sense to refinance. This is especially true if your current home loan rate is scheduled to increase in the coming year.

When Would You Not Want to Refinance a Housing Loan?

After considering all of the reasons to refinance, it might be hard to imagine a scenario in which refinancing isn't a prudent idea. However, there are some situations in which refinancing is not completely advantageous.

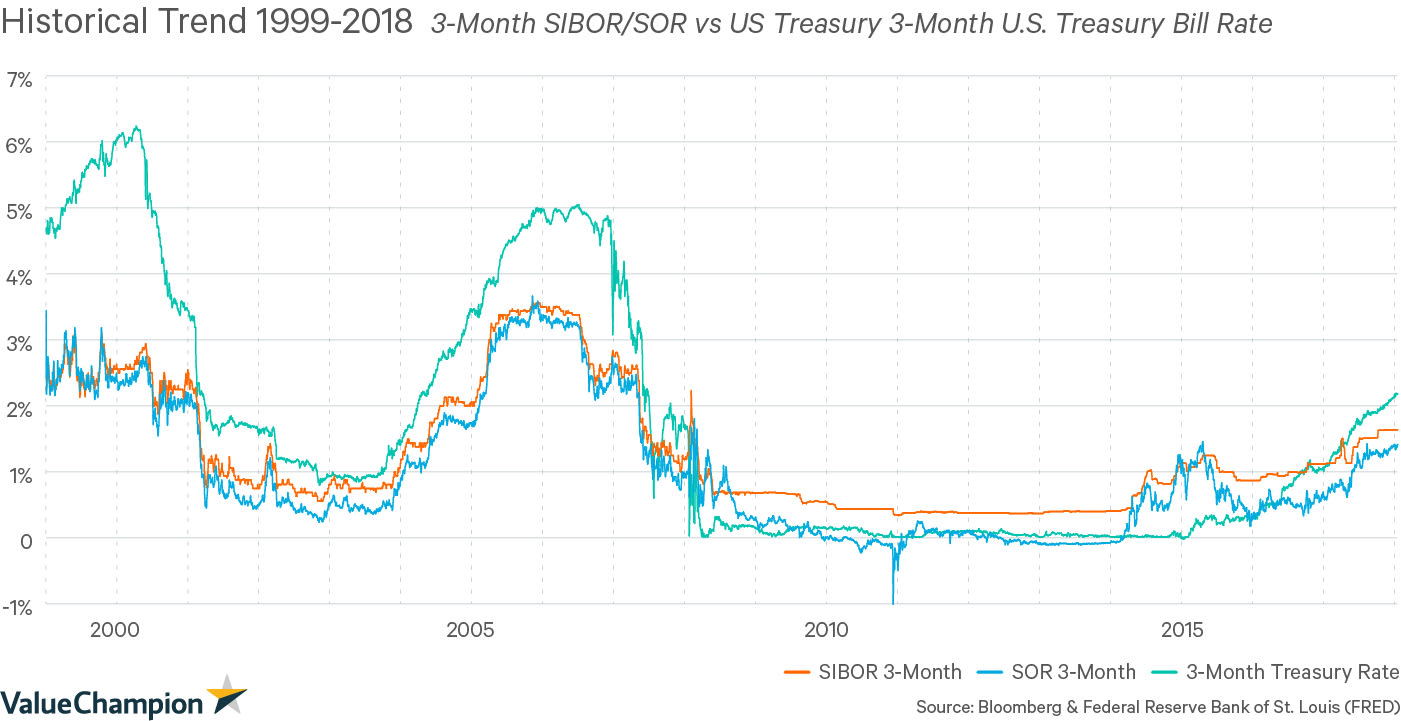

For example, if you have reason to believe that interest rates will decrease in the next few years, it would be reasonable to delay refinancing your home loan in order to obtain lower rates in the future. There are a number of reasons that this scenario could occur. For example, if there's an economic downturn on the horizon, it's likely that the U.S. Federal Reserve will lower its rates, which then in turn will have similar impact on the interest rates in Singapore. In fact, the U.S. Fed has already halted its rate hike program to prepare for any softness in the economy. On the flipside, though rates have risen in the past few years, interest rates are somewhat low on a global level, including in the U.S., the EU and Japan. Furthermore, central banks around the world have been planning to return rates to more "normal" (i.e. higher) levels over the long term, suggesting that there may be room for rates to increase in the future. Regardless of what happens, borrowers can always refinance every 2-3 years, which means refinancing is generally a good strategy to lower cost over the long run.

Those considering refinancing in order to save money should also be aware of the various costs associated with refinancing a home loan. For example, homeowners will face legal and valuation fees among other costs in order to refinance. Thankfully, some banks offer subsidies for these fees. However, it is important to be aware of the possibility of these fees before applying to refinance your housing loan.

How to Stay Informed

While it is difficult to accurately predict the movement of interest rates, there are a few ways for homeowners to stay up-to-date on interest rate changes. First, interest rates in Singapore are highly correlated with those in the United States, though they are not officially pegged to those in the U.S. For this reason, it is important to pay attention to interest rate announcements from the U.S. Federal Reserve. In recent weeks, there has been speculation that the Fed might cut rates. However, the officials from the Fed have maintained that rates will be kept flat in the short-term, with a long-term philosophy of returning rates to higher levels.

Additionally, individuals can stay informed by checking real-time, home loan refinancing offers, which are always free to view on sites like ValueChampion.