3 Tips to Get the Most Out of a Personal Loan This Holiday Season

When you’re facing a large, one-time expense and don’t have the cash on hand to pay it, it could be tempting to take out a personal loan. Such temptation is especially strong around this time of the year, when the festive spirit kicks in and many occasions for gifts, events and holidays arise. With Singaporean households already holding more than S$10,000 of personal loans per capita, however, consumers should be methodical about taking on additional debt. Here, we discuss some tips and precautions you could take to get the most out of a personal loan while minimising cost.

Utilise different personal loans for different occasions.

As a rule of thumb, you shouldn't just take a personal instalment loan for every occasion. Banks actually offer a fair number of options that can be useful in different scenarios. For example, personal loans are ideal for people who need to borrow few thousand dollars. Most people would need at least a year or longer to repay such an amount, and instalment loans make this possible by breaking up your loan repayment into small, regular chunks. If you are looking for some additional financing for a special holiday or an emergency, this would be the best available option.

On the other hand, a personal line of credit could be more ideal for those who are looking to borrow a smaller sum (i.e. few hundred to a thousand dollars) that can be readily paid back. While instalment loans charge a penalty fee for repaying your loan early, lines of credit can be paid back anytime. As long as you shop for the best option wisely, you could even find some offerings that waive your annual fee and offer very low interest rates. If you just want to borrow few hundred dollars for some help with your gifts, and if you can readily repay the loan quickly in a few months, a line of credit could be a very cheap source of financing.

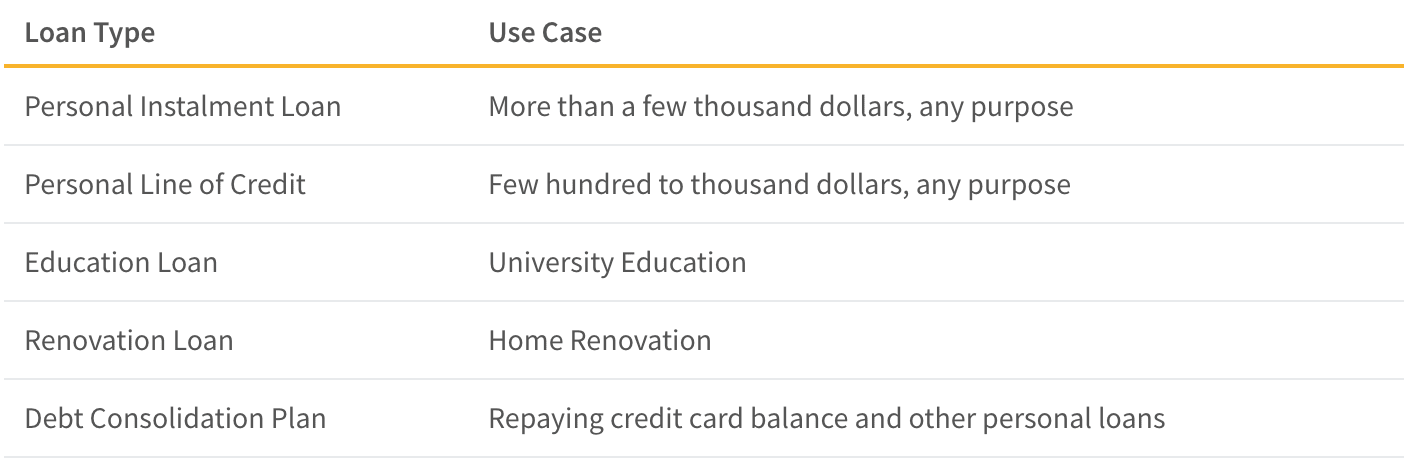

Finally, there are more "specialised" personal loans that offer low interest rates. Unlike instalment loans or lines of credit where the money can be spent for any number of purposes, these other loans can only be used for a predesignated use, like redoing your home decor as a gift to your family or cleaning out your credit card debt to kick off the new year. Please see our summary of personal loans and our recommended use case for each of them in our summary table below.

Before getting a loan, prepare a detailed plan of how you are going to repay it

Too often, people focus too much on the fact that they "need" or "want" money now. In contrast, not many people actually have a clear plan about how and when they will redeem their loans. This is because most people are short-sighted, and are too busy dealing with their present concerns and desires that they forget to anticipate the consequences of their actions. A nicer gift or holiday sure sounds nice now; without a concrete plan on how to get rid of this debt, however, this balance can quickly balloon due to their relatively high interest rates. A missed payment leads to late penalty charges and additional interest, which is how a countless number of people end up with more than S$100,000 of personal debt.

Instead, you should have a very detailed plan on how you are going to repay your loan. Perhaps, you know exactly how much bonus you are going to receive at the end of the year, which will be sufficient to repay your loan. Or, you might know that you will be getting a certain amount of raise in your salary next year, and the extra income should be able to meet your monthly loan obligations. Either through additional income or reduced spending, you should first build a high level of certainty that you will be able to meet your obligations before agreeing to take out a loan. Remember, when it comes to loans and personal finances, hope is not a strategy.

Avoid other more easily available alternatives

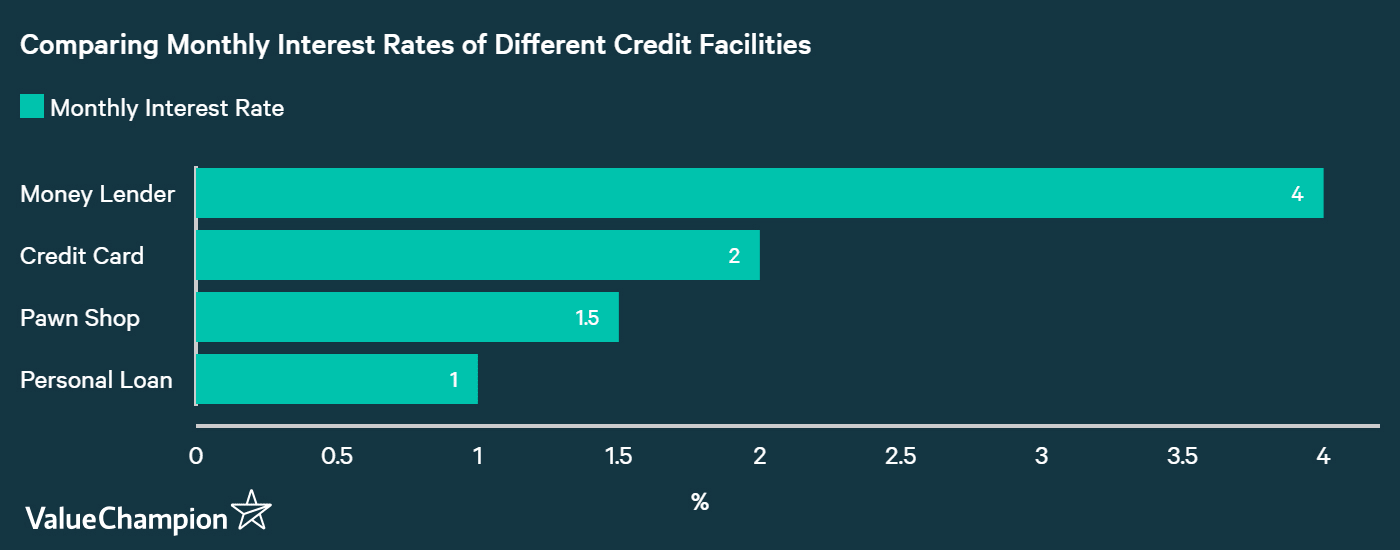

Lastly, you should always avoid other alternatives that might be more visible and easily available. Most of these options are vastly more expensive than personal loans from a bank, and much more likely to lead you to financial ruin.

The most probable case of these alternatives is credit card related financing. Because credit cards are so easy to use, a lot of people end up just building a large balance and leaving it unpaid. However, unpaid credit card balances accrue an annual interest rate of at least 25%, which is multiples higher than rates of any of the options we discussed above. Credit card cash advance is even worse, as they tend to carry an even higher cost.

Going to a licensed moneylender is also financially risky. These lenders can charge up to 4% of monthly interest, which can easily translate to well over 50% APR with compounding effect. Borrowing from an unlicensed moneylender may be the worst option of all. These lenders charge outrageous interest such that it may very well be impossible to repay your loan ever. Not only that, they are known to harass and threaten their borrowers.

Parting thoughts

Finally, one way to avoid needing a personal loan in the first place is to establish an emergency fund that you can use for those big bills that you either can't or don't want to avoid. Many financial planners suggest saving at least three to six months of living expenses in an account that you can get cash from quickly, such as a bank savings account or a money market mutual fund. If you start saving now to prepare such a rainy day fund, you could have a much happier and more financially flexible holiday season in the future.